News & Media

Media Coverage, Insights, Thoughts, & Musings

Why We Invested: Arcstone

The team at REFASHIOND Ventures explains why they invested in Arcstone, a connected manufacturing platform.

REFASHIOND Seed LP Update / Q1 2022

Why We Invested: Sunthetics

Wherein we explain why REFASHIOND Ventures invested in Sunthetics, a startup that has invented a machine learning platform accelerates the discovery, development, and optimization of formulations, processes, and products in the chemicals industry.

Why We Invested: Greenscreens.AI

Wherein we explain why we invested in Greenscreens.AI, the dynamic pricing infrastructure for the logistics industry.

Why We Invested: Leaf Logistics

The team at REFASHIOND Ventures explains why the fund invested in Leaf Logistics, a startup that is building a data-driven platform for the planning, coordination, and execution of freight transportation and logistics at scale.

Why We Invested: Shipday

In this blog we explain why we decided to invest in Shipday, a startup that makes it easy for any merchant to create a delivery service by providing all the data and decision analytics infrastructure that is necessary for merchants of any size to set up scalable delivery operations without the need to know how to create the software needed to manage such a service.

Why We Invested: Stimulus

REFASHIOND Ventures announces its investment in Stimulus, a relationship management platform for sourcing and procurement teams at large companies.

Towards A Partnership Model for Family Offices and Emerging Venture Firm Managers (#SupplyChainTech #FOinVC Focus)

We examine why Family Offices seeking exposure to early-stage technology venture capital should partner with emerging venture capital firms. We propose a partnership model rather than the narrative in the media that pushes outright rivalry. We outline 9 different approaches by which family offices can engage with the community of emerging venture fund managers. We feature commentary from practitioners. This report is uniquely deeply researched and is meant for senior decision makers at family offices in any part of the world seeking some help as they try to make sense of large volumes of sometimes contradictory and confusing information that is difficult to synthesize. and distil into actionable conclusions.

Commentary: Rolling Funds on AngelList Are The Best Way For Accredited Individual Investors to Start Investing in Venture Capital Funds

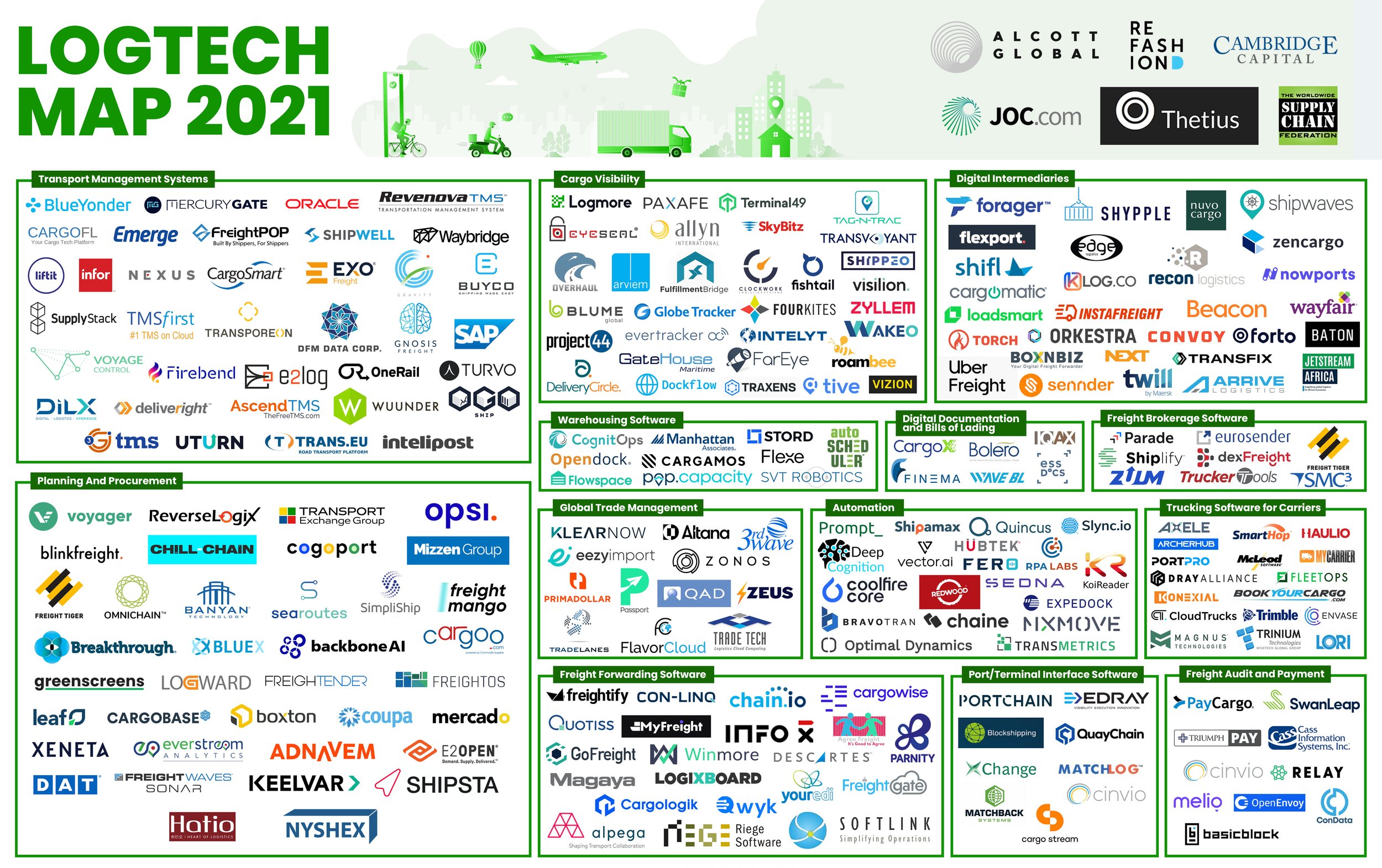

New Logistics Technology Market Map Seeks to Center Buyers of Logistics Technology and Services

A group of volunteers from different organizations around the world has published the logistics’ industry’s first open source market map that seeks to center buyers of technology products and services for supply chain logistics.